before a Senate subcommittee, 1989. (The New York Times/Andrea Mohin)

~ Milan Kundera

~Yogi Berra

Chronologies

Chronologies are valuable tools in understanding the financial system and economy. For chronologies of institutions and events involved in $21 trillion missing from the U.S. government since federal fiscal 1998, see:

- Missing Money Chronology

https://hudmissingmoney.solari.com/missing-money-chronology/ - Chronology – Dillon Read & Co., Inc. & the Aristocracy of Stock Profits

https://dillonreadandco.com/resources/documents/Chronology/DUNWALKE_Chronology_Fin_June2007.pdf - Chronology – Hamilton Securities Litigation

http://www.dunwalke.com/media/chronology.htm

TABLE OF CONTENTS

I. Prologue: Philadelphia (December 1950–May 1978)

II. Prologue: Wall Street (August 1978–April 1989)

III. Assistant Secretary of Housing-Federal Housing Commissioner U.S. Department of Housing & Urban Development, Bush I (April 1989–August 1990)

IV. Building Hamilton Securities (August 1990–November 1995)

V. The War on Hamilton (November 1995–September 2001)

VI. The War on Everyone (September 11, 2001–January 2006)

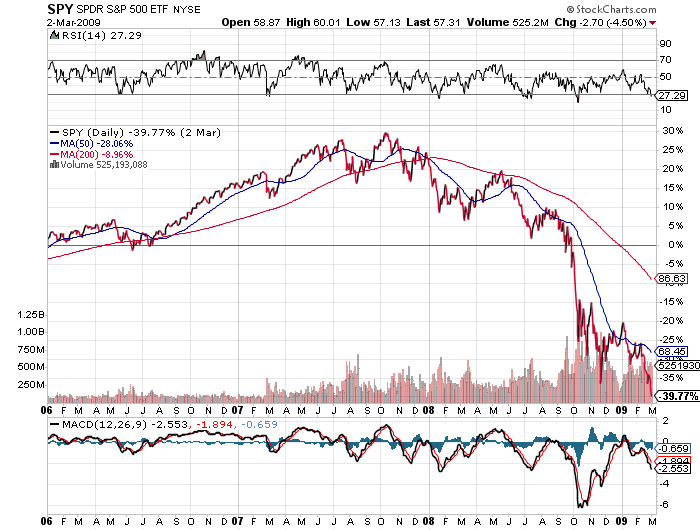

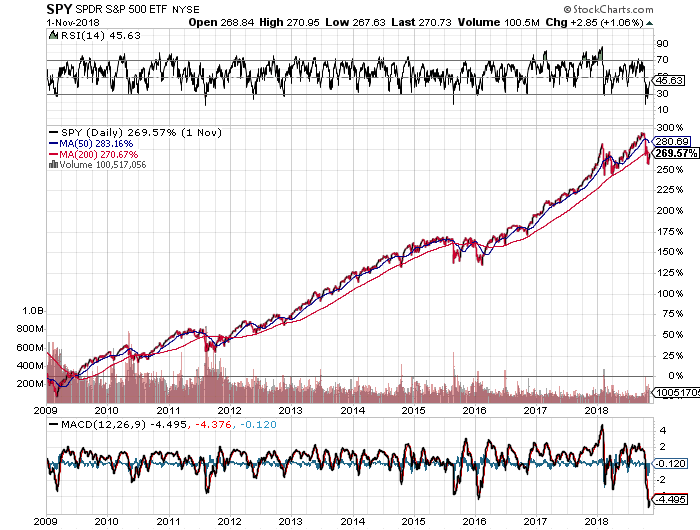

VII. The Financial Crisis (January 2006–November 2009)

VIII. Launching The Solari Report (November 2008–November 2012)

IX. Planet Equity; Planet Debt (November 2012–November 2016)

X. Fortress America (November 2016–May 2017)

XI. The Skidmore Report (May 2017–October 2018)

XII. Never Never Land—The Post FASAB 56 World

I. Prologue: Philadelphia

December 1950–May 1978

~ Catherine Austin Fitts as a child contemplating a foreclosure sign

by order of the Assistant Secretary of Housing-FHA Commissioner

My childhood home was a brick row house in West Philadelphia at 48th and Larchwood. My father bought our home with a Veterans Administration (VA) insured mortgage after returning from service as a surgeon in WWII. Ours was a city neighborhood filled with families and children who lived and played on our porches, stoops, and sidewalks.

When I was a young girl, there were four boarded-up home foreclosures on the city block catty-corner to our own. The boarded-up houses had been financed with Federal Housing Administration (FHA) insured mortgages. They had large foreclosure signs that boldly announced, “By order of the Assistant Secretary of Housing-Federal Housing Commissioner.”

There was a family of six people living in a one-bedroom apartment in a house across 48th Street. My young mind could not understand why four perfectly good houses could be boarded up and lie empty for years, while six people—who would appreciate and take good care of a home—lived in a one-bedroom apartment. I intuitively understood that dense living conditions and empty homes were harmful for both productivity and equity values in our neighborhood.

Whenever I walked by the foreclosure signs, I would look at the long title, “By the order of the Assistant Secretary of Housing-Federal Housing Commissioner,” and think, “Who is that as***le?” In 1989, when I was sworn in as the Assistant Secretary of Housing-Federal Housing Commissioner in the first Bush Administration, I realized immediately, “Uh-oh, I’m the as***le.”

I saw a great deal destroyed in West Philadelphia. Speculative homebuilder deals that converted quickly to boarded-up foreclosures were one of the classic Housing and Urban Development (HUD) frauds. It was so prevalent through successive housing bubbles throughout my career that it was later immortalized by the TV show, The Sopranos.

In West Philadelphia in the 1950s and 1960s, however, HUD frauds were not our worst problem. Narcotics trafficking and the increased enforcement and covert violence that came with it steadily eroded our community. The lies that flowed glibly through our new television sets eroded our culture. We stopped talking to each other on our stoops and stayed inside to watch the screens that artfully persuaded us to borrow and buy more and trust each other less. Taking on greater mortgage debt, some of our neighbors escaped to bigger homes in the suburbs. People spent a great deal of time and money on the hope that they could “get away” to a place that was safe.

Philadelphia was where I learned to live with the absence of safety and with violence. I tell one of those stories in the 3rd Quarter 2017 Wrap Up: Control 101.

When I was in high school, a series of stabbings occurred near the University of Pennsylvania, emanating towards our area. There was an unusual—and professional—feeling to them. So one day, I took out the newspaper reports and a map to trace the progression. There was indeed a pattern. Each murder was one block south and two blocks west of the previous murder. Each murder occurred after the same regular amount of time. If the pattern continued, the next murder would occur the coming week on the corner where I lived.

Several nights later, my parents were giving a dinner party. I went to visit a friend, and then headed home when the party was expected to wind down. I drove home and parked around the corner. As I parked the car, I saw two men sitting inside the car in front of mine with the motor on and their lights off. I got out of my car, and so did they. I did not see anything else as I ran at Olympic record speed to my house, up the stairs, and up to the front door. The only thing I heard was the sound of footsteps running behind me.

As luck would have it, my father was opening the door for guests returning home. I threw out my arms, gathering all of them with me, as I went flying into the hallway. Presented with a large party of surprised witnesses, the two men took off in a dash. It was one of many times that my appreciation for the thin veil that lies between us and the physical force used to control us may have saved my life. Growing up in a rough neighborhood has had clear advantages.

Ten years later, my mother’s body was found on the roof of our home in February, 1976. I knew my father agreed with me that it was an assassination when he insisted on receiving the insurance. It was too late to protect his wife, but he was not going to allow his family to be cheated out of the insurance monies. It fell to me to arrive on the scene and take charge of the family and funeral arrangements. I believed that if I handled matters discreetly, I could protect my father from a similar fate. However, he died four years later under suspicious circumstances. The lies surrounding their deaths became part of the accumulated lies that eventually destroyed what remained of our family. In the meantime, the machinery that harvests people and neighborhoods with a lethal combination of drugs, media, mortgage fraud, and enforcement kept getting more powerful. I wanted to know why.

One of the things I learned growing up was that the fastest way for me to understand reality was to identify the actual transactions that were happening and estimate the allocation of time and resources, or, “how the money worked.” I was told as a young child that I tested as a math genius. Converting the gruesome or incomprehensible side of life into a mathematical flow seemed to my childlike mind a practical way of unpacking the mysteries of adult behavior. For many situations, it was the only way to make sense of things as I traveled back and forth between multiple cultures and places. I got a better understanding of what was happening by following transactions than if I relied on people’s description of what was happening or depended on the local and national news media. What people said they were doing and what they were actually doing were distinctly different things. Our culture lived in a state of deep denial, and it seemed to grow deeper every year.

This was one of the reasons I attended Wharton—the business school at the University of Pennsylvania—from 1976-78, receiving my MBA in the spring of 1978. Still trying to understand “how the money worked,” I joined Goldman Sachs as an intern for the summmer of 1977 and then, after graduation, headed to New York and a job in investment banking on Wall Street at Dillon Read & Co., Inc.

I was going to learn how the money worked and do something about it.

Solari Report:

The Devil’s Chessboard with David Talbot

The Deep State: Part I and Part II

Videos:

Dillon Read & the Aristocracy of Stock Profits

Articles:

“The Popsicle Index”

https://library.solari.com/the-popsicle-index/

“Meditations at the Crossroads”

https://library.solari.com/meditation-at-the-crossroads-2/

“My Family”

https://library.solari.com/my-family/

Catherine Austin Fitts: Resume

https://home.solari.com/resume/

II. Prologue: Wall Street

August 1978–April 1989

(Courtesy Robert Gambee and his book Wall Street)

~ Clarence Dillon

One of the things I learned working on Wall Street was about the dangers of working for the federal government. I describe one story in my online book Dillon Read & Co., Inc. & the Aristocracy of Stock Profits:

James Forrestal’s oil portrait always hung prominently in one of the private Dillon Read dining rooms for the eleven years that I worked at the firm. Forrestal, a highly regarded Dillon partner and President of the firm, had gone to Washington, D.C. in 1940 to lead the Navy during WWII and then played a critical role in creating the National Security Act of 1947. He then became Secretary of War (later termed Secretary of Defense) in September 1947 and served until March 28, 1949. Given the central banking-warfare investment model that rules our planet, it was appropriate that Dillon partners at various times led both the Treasury Department and the Defense Department.

Shortly after resigning from government, Forrestal died falling out of a window of the Bethesda Naval Hospital outside of Washington, D.C. on May 22, 1949. There is some controversy around the official explanation of his death—ruled a suicide. Some insist he had a nervous breakdown. Some say that he was opposed to the creation of the state of Israel. Others say that he argued for transparency and accountability in government, and against the provisions instituted at this time to create a secret “black budget.” He lost and was pretty upset about it—and the loss was a violent one. Since the professional killers who operate inside the Washington beltway have numerous techniques to get perfectly sane people to kill themselves, I am not sure it makes a big difference.

Approximately a month later, the CIA Act of 1949 was passed. The Act created the CIA and endowed it with the statutory authority that became one of the chief components of financing the “black” budget—the power to claw monies from other agencies for the benefit of secretly funding the intelligence communities and their corporate contractors. This was to turn out to be a devastating development for the forces of transparency, without which there can be no rule of law, free markets or democracy.

I studied Forrestal’s oil painting with his solemn stare during many a private lunch—each time reminded that government service was an important duty and honor in the Dillon tradition, but it was a dangerous business. Congressional Committees had roughed up Clarence Dillon during the Pecora Commission hearings in 1933 that investigated the cause of the stock market crash. Forrestal had died. Douglas Dillon was Secretary of the Treasury when Kennedy was assassinated.

On Wall Street, I also learned about what is now sometimes referred to as “the deep state.” At the time, Dillon Read was run by our chairman Nicholas F. Brady and president John Birkelund. Here’s more from Dillon Read & Co., Inc. & the Aristocracy of Stock Profits:

One of my favorite Dillon Read officers was the son of a former Dillon chairman and, thus, remarkably wise about the ways of the firm. I sought him out after a Birkelund temper tantrum and said that Birkelund was not at all like a “Brady Man” and that I was surprised at Nick’s choice. My colleague looked at me with surprise and said something to the effect of “Brady did not choose Birkelund. Birkelund is a ‘Rothschild Man.’” I then said something about Dillon being owned by the Dillon partners, so what did the Rothschilds have to do with us? My colleague rolled his eyes and walked away as if I was an interloper out of my league among the moneyed classes—clueless as to who and what was really in charge at Dillon Read and in the world.

I also saw the importance to the partners of Dillon’s relationship with RJR Nabisco and the fight for control of RJR that resulted in the book and movie, Barbarians at the Gate. Many years later in 2002, when the European Union filed a lawsuit against RJR Nabisco for money laundering with numerous factions of transnational organized crime syndicates, the success of the KKR syndicate (another private equity firm) in paying off the leveraged buyout debt made much more sense than it did at the time. I describe these events in the chapter on RJR in Dillon Read & Co., Inc. & the Aristocracy of Stock Profits. From the European Union filing:

“The RJR DEFENDANTS have, at the highest corporate level, determined that it will be a part of their operating business plan to sell cigarettes to and through criminal organizations and to accept criminal proceeds in payment for cigarettes by secret and surreptitious means, which under United States law constitutes money laundering. The officers and directors of the RJR DEFENDANTS facilitated this overarching money-laundering scheme by restructuring the corporate structure of the RJR DEFENDANTS, for example, by establishing subsidiaries in locations known for bank secrecy such as Switzerland to direct and implement their money-laundering schemes and to avoid detection by U.S. and European law enforcement. This overarching scheme to establish a corporate structure and business plan to sell cigarettes to criminals and to launder criminal proceeds was implemented through many subsidiary schemes across THE EUROPEAN COMMUNITY. Examples of these subsidiary schemes are described in this Complaint and include: (a.) Laundering criminal proceeds received from the Alfred Bossert money-laundering organization; (b.) Money laundering for Italian organized crime; (c.) Money laundering for Russian organized crime through The Bank of New York; (d.) The Walt money-laundering conspiracy; (e.) Money laundering through cut outs in Ireland and Belgium; (f.) Laundering of the proceeds of narcotics sales throughout THE EUROPEAN COMMUNITY by way of cigarette sales to criminals in Spain; (g.) Laundering criminal proceeds in the United Kingdom; (h.) Laundering criminal proceeds through cigarette sales via Cyprus; and (i.) Illegal cigarette sales into Iraq.” ~ RJR Nabisco, Dillon Read & Co., Inc. & the Aristocracy of Stock Profits

Investment banking suited me. I developed a reputation for taking on the transactions that others thought could not be done—typically, transactions that involved many different constituencies and financial flows. I liked sorting out highly complicated public-private financial flows. I liked working with people from scores of different industries, places, and worlds. I became a managing director and member of the board of directors in eight years—a record time. I could not imagine that I would ever have a career other than as an equity owner of Dillon Read. I did not love everything and everyone in the environment, but I loved my investment banking work.

While at Dillon Read, I had my first run-in with fraudulent apartment deals and municipal housing bonds with credit dependent on mortgages insured by FHA/HUD on Wall Street, also described in my online book Dillon Read & Co., Inc. & the Aristocracy of Stock Profits. This may have had something to do with Nick Brady’s first comment to me when I informed him that I was going to be nominated as Assistant Secretary of Housing-Federal Housing Commissioner in 1989: “You can’t go to HUD—HUD is a sewer.” My then-husband was a successful securities attorney who specialized in mortgage securities. As the housing bubble exploded through the 1980s, his business boomed. The banker who led the housing deals was recruited by John Birkelund and after leaving Dillon went to Rothschild, Inc., where John had worked before moving to Dillon Read.

I also had my first introduction to the concept of entrainment technology and subliminal programming. I overheard a discussion of this technology in 1984 in anticipation of its rollout on TV. This brief insight was frightening—and was the reason I gave up watching television that year.

The Dillon Read partners sold the firm to Travelers Insurance in 1987, shortly after I became a partner. With Nick leaving to become Secretary of Treasury at the very end of the Reagan administration, the handwriting was on the wall. With John Birkelund assuming control of the firm, I was no longer welcome at Dillon Read. It was not the only thing to come apart. Shortly after the firm was sold, my marriage ended in separation. I was divorced two years later.

I had an offer from another firm to move when our non-compete contracts ended. I anticipated I could have more, as I had turned down inquiries from headhunters on the basis that I would honor my non-compete contract and my promise to Brady that I institutionalize my relationships and book of business before I left the firm. My other option was to go into the Bush administration as several other partners were planning to do.

There were several reasons why I wanted to work in the federal government. I had become convinced after eleven years on Wall Street—with exposure to many different parts of the economy and financial markets—that the U.S. economy was engineered through Washington, by monetary policy engineered by the Federal Reserve and fiscal policy engineered by Congress and the Executive branch. To understand how the money in one neighborhood in West Philadelphia worked—let alone figure out how to get it to work well—I needed to understand federal finances. Another reason was that I was confident that entering government service would ensure that the business I had built would stay at Dillon Read. Keeping this promise to Brady and the firm was very important to me.

My loyalty was not reciprocated. I went to work at HUD despite the fact that Nick Brady, now Secretary of the Treasury in President George H.W. Bush’s administration, blackballed me with the Bush transition team. I now believe that Brady did so for reasons relating to my parents’ deaths, although it took me many years to come to that conclusion. It was not the first time that Brady had blackballed me. He tried to decline supporting me when Ray Price, executive director of the Economics Club, insisted that he support me for membership in the Economics Club. Ray stood his ground, and I did join with Brady’s nominal support. Brady also blackballed our partner Peter Flanigan’s effort to put me up for the Links Club in New York. Peter was surprised and embarrassed and had me accepted at the Bond Club instead.

Former Congressman and incoming Secretary of HUD, Jack Kemp, was willing to override Brady’s veto. A member of the transition team insisted that Kemp and Brady loathed each other, which is how I got the interview with Kemp. Kemp had a HUD scandal on his hands and wanted someone clean with strong financial credentials.

Solari Report:

Entrainment, Subliminal Programming and Financial Manipulation with Adam Trombley

https://home.solari.com/entrained-subliminal-programming-and-financial-manipulation/

Videos:

Blackballed – See first 25 minutes of Dark Journalist interview, August 2018

https://www.youtube.com/watch?v=yzc0KXO2DVw

Audios:

The “Kemp Tapes” – In the late 1990s, Catherine’s attorneys asked her to record her recollections of working in the Bush Administration. She recorded a series of cassettes that, over time, passed around the Internet.

https://home.solari.com/the-kemp-tapes/

Articles:

“The Wonder Woman of Muni bonds,” Business Week, Feb. 23, 1987

https://home.solari.com/wp-content/uploads/1989/Business_Week_Wonder_Woman_of_Muni_Bonds.pdf

“Buffet’s Big Bet on US Federal Mortgage Credit & Housing”

https://library.solari.com/buffetts-big-bet-on-us-federal-mortgage-credit-housing/

Book Review: “Cotton Candy Land: A review of Nick Brady’s A Way of Going”

https://library.solari.com/cotton-candy-land-2/

Books:

Dillon Read & Co., Inc. & the Aristocracy of Stock Profits, by Catherine Austin Fitts, March 2006: A comprehensive business-school-quality case study of the Washington-Wall Street relationship depicting the Hamilton litigation and surrounding events in the larger context of the central banking-warfare model and political economy operating in the U.S. today.

https://dillonreadandco.com

III. Assistant Secretary of Housing-Federal Housing Commissioner

U.S. Department of Housing & Urban Development, Bush I

April 1989–August 1990

~ Nicholas F. Brady, Secretary of the Treasury, Bush I to Catherine Austin Fitts, 1989

The first Bush administration began at the end of a housing and mortgage bubble during the 1980s that was marked by significant financial fraud—all of which contributed to the collapse of the savings and loan (S&L) industry.

The U.S. Treasury, under the leadership of now Secretary of Treasury Nick Brady, worked with Congress to pass the Federal Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA), which created the Resolution Trust Corporation (RTC) to resolve failed savings and loan institutions and related housing and mortgage portfolios and fraud. Of the 3,234 savings and loan associations in the U.S., 1,043 (32%) failed between 1986 and 1995. During this period, the financial controls in the federal mortgage credit programs were overridden, causing a significant influx of defaulted mortgages and foreclosed assets. This included the largest federal mortgage insurance operations in the federal government, the FHA at HUD. Until the creation of the RTC, the FHA had the largest property disposition operation in the country.

I arrived in Washington in April, 1989. I described my responsibilities as Assistant Secretary of Housing in Dillon Read & Co., Inc. & the Aristocracy of Stock Profits:

As Assistant Secretary for Housing-Federal Housing Commissioner, I was responsible for the operations of the Federal Housing Administration (FHA), which was the largest mortgage insurance fund in the world. FHA at that time had annual originations of $50-100 billion of mortgage insurance and an outstanding official portfolio of $320 billion of mortgage insurance, mortgages and properties. (CAF note: Today, it is officially $1.1 trillion.) Leading the FHA necessitated significant understanding of how homes are built, how mortgages finance thousands of communities throughout America and how investors finance the process by buying securities in pools of mortgages. My responsibilities included the production and management of assisted private housing; management of an organization of 7,000 employees in 80 offices nationwide; and development of network information systems and tools. In addition, I served as advisor to the Secretary of HUD on financial markets regulatory responsibilities, including the RTC Oversight Board, Federal Housing Finance Board, Home Loan Bank Board System, and the mortgage GSEs—Fannie Mae and Freddie Mac.

While my experience as Assistant Secretary cleaning up significant mortgage fraud that lost the government billions during the 1980s confirmed that HUD’s financial reputation was deserved, leading the FHA provided invaluable insight into how government management of the economy one neighborhood at a time really harms communities. Hence, access to the “real deal” on real estate and the mortgage markets was an opportunity. If you want to see the real economy in a place, you absolutely want an accurate map of the financial flows in that system—starting with the real estate.

Shortly after arriving at HUD in April 1989, I began to learn about the FHA Coinsurance program. Since 1984, HUD/FHA had allowed private mortgage bankers to issue federal credit to guarantee multi-family apartment projects. After issuing $9 billion in mortgage guarantees, HUD/FHA was to lose something approaching 50% of the value of the portfolio—a level of losses hard to explain with mortal logic. When my staff approached me with a proposal to bail out a mortgage company so they could continue to lose money for us, I asked why we should spend money to lose more money in a way that would harm communities, not to mention the transaction they were proposing was illegal. After a long silence during which 30 staff members intently studied their feet, one brave soul explained to me that the mortgage bank was owned and run by a major Republican donor. Shocked, I said. “I am a major Republican donor,” and pointing to my presidential cuff links that were adorning my French cuffs, “I got a pair of cuff links. You get cuff links. You don’t get $400 million of federal credit to throw down the drain.” My staff looked at me like I was so naive and clueless that there was no point in trying to communicate with me—better to let me learn the hard way.

Within minutes, a screaming Jack Kemp, furious that I had not provided illegal subsidy to keep the mortgage banking company going (despite his orders to stop anything corrupt or illegal), called me on the carpet. The problems were compounded by the opinion of HUD General Counsel Frank Keating, who had joined from DOJ, that we did not have to honor our contracts. Rather we could abrogate contracts and ignore the law. If those who had been harmed sued us, Frank said, by the time they won “we will be gone.” Frank was to help write and pass new laws and administrative policies to use HUD as a player in War on Drugs activities to generate enforcement revenues. After many dirty tricks and much ranting and raving, HUD was to turn the defaulted coinsurance portfolio over to a private contractor named Ervin & Associates, a newly created company founded by John Ervin, a former employee of Harvard’s HUD property management company, NHP, Inc. (formerly National Housing Partnerships.)

The coinsurance program was so corrupt that even the Mortgage Bankers Association lobbied HUD to clean it up. After issuing $9 billion of federal insured multifamily mortgages in five years before I shut it down, the coinsurance was ultimately to have a default rate of 50% despite a rich provision of capitalized interest. I describe what happened in more detail in the “Kemp Tapes.”

My concern for money disappearing illegally from the federal government began when I first arrived at FHA. One way to summarize my professional life since the day of my arrival in Washington in 1989 is that I have watched, documented, and tried to stop money disappearing from the federal government ever since.

There are as many ways to steal money from HUD and the federal government as there are recipes in the Joy of Cooking cookbook. As long as the federal government can collect taxes and sell Treasury securities and the Federal Reserve banks operate a fiat currency system supported by a global military, both without real audits or lawful disclosure by agency and Congressional district, there are always more assets and money that can go missing. The existing federal credit mechanism is a harvesting system—it comes with a license to steal. That is why elections are hotly contested—not because the executive branch controls and governs the U.S. government. Rather, it is because the political officials who control the executive branch control a portion of the private patronage that comes with being the operator of a financially secret operation managing trillions in credit, assets, spending, and related data and regulations.

The FHA mortgage insurance operations are generally divided between two funds. The coinsurance program described above was run from the FHA General Fund, which included the multifamily, hospital, and other high-risk insurance programs. The larger fund was the Mutual Mortgage Insurance (MMI) Fund, which funds the single-family residential mortgage insurance originated by FHA. The official amount of outstanding mortgage insurance in force in the MMI Fund as of fiscal 2018 was approximately $1.1 trillion, with the fiscal 2018 budget requesting authority to issue $400 billion in new mortgage insurance.

The MMI Fund is required by law to be financially self-sustaining; that is, mortgage premiums have to cover losses on defaults and the cost of operations. One of my immediate challenges in 1989 was to determine what our finances actually were. The accountants for the FHA reported to a different Assistant Secretary, and I was not allowed to speak with them. After several months of politicking, I was able to get them moved over to my operation, only to discover that the MMI Fund was losing $11 million a day. It took several more months to determine where the losses were occurring. We were generating a profit in eight of ten federal regions and losing the profits (and more) in the two regions—Regions VI and VIII—defined by S&L and Iran-Contra fraud. Region VI included both Texas and Arkansas.

The management of the single-family operations at FHA is traditionally run by the Deputy Assistant Secretary of Housing-Single Family (DAS-Single Family), who reports to the Assistant Secretary of Housing-Federal Housing Commissioner, who reports to the Secretary of HUD. The HUD Secretary and the Assistant Secretary of Housing-Federal Housing Commissioner are both Presidential appointees. They are nominated by the President and approved by Senate confirmation after an extensive FBI background check.

The Deputy Assistant Secretary of Housing is traditionally recommended for appointment to the Secretary by the Assistant Secretary of Housing, reviewed and approved by the White House, and then appointed by the Secretary after a background check.

When I arrived at HUD in April 1989, before I was confirmed as Assistant Secretary of Housing, one of my first jobs was to review and recommend the people for my four main deputy positions, including the DAS-Single Family. One of the resumes that our transition team forwarded to me was for Ronnie Rosenfeld, who I recommended to HUD Secretary Jack Kemp for appointment as the DAS for Single Family.

Shortly thereafter, I received a call from the executive director of the National Association of Home Builders (NAHB). The message said it was urgent. Could he and the president of NAHB meet with me as soon as possible? Soon enough, I found myself in my small temporary office (I had not yet been sworn in) with the executive director and the president of NAHB.

The NAHB president was quite upset. It seemed, she said, that I had made a terrible error. I had recommended Ronnie Rosenfeld for nomination as DAS for Single Family when in fact that appointment, she said, was hers to make. The DAS for Single Family essentially reported to her. She did not seem to be aware that the growing HUD scandals that were part of the S&L crisis and Iran-Contra signaled a new day. In the meantime, I was beginning to understand why we were not in compliance with our existing financial management laws.

I explained that the new Administration was planning on running things by the book and that the DAS for Single Family was going to be appointed by the Secretary with approval of the White House. I was only going to recommend to the Secretary candidates qualified to do an excellent job based on merit. She needed to understand that the line management of a $320 billion-plus government insurance program would report to government officials—not to the president of the NAHB.

The president stood up, pointed her highly lacquered finger in my face and, using the F-word liberally, explained, “I will have you fired.” I looked her in the eye and said, “You know you probably can, but it will take you a while. In the meantime, I am going to get this operation on a sound financial footing.” I then picked up the phone, called security, and requested that a security guard physically evict her from the building. Inspired by my call, the executive director quickly hustled the spitting and yelling president out of my office and down the hall to the elevators.

Before Ronnie arrived on the job, I moved out from the Single Family office the fellow who was processing land development deals with the company said to be owned by the NAHB president and, with the assistance of now Deputy Assistant Secretary of Housing Ronnie Rosenfeld, shut down the program. I was fired approximately eighteen months later, in part for my refusal to implement illegal orders, but by that time I had the FHA on a sound financial footing. However, that solid financial footing was not to last. If anything, it turned out that I righted the ship so that a new and larger round of stealing with the 1990s housing bubble could begin.

One of my greatest frustrations when leading the FHA was in trying to get reliable data regarding our mortgage insurance programs—particularly breakdowns contiguous to local communities and political jurisdictions. I would consistently find communities where government policies were not coordinated by place—even though the opportunities to do so and to save money were compelling. Accurate data by county or by Congressional district were essentially impossible to get, and more than a few private contractors and accounting firms would turn apoplectic if you tried to get such data. I discovered that “place-based financial data” were the federal government equivalent to cigarettes in a prison. How anyone was supposed to responsibly operate a mortgage insurance portfolio of hundreds of billions of credit risk without reliable property, mortgage, or local economy data was beyond me. Perhaps that was why my position had been held by eight people in the prior eight years. By the time they realized what they needed to do their job, they were gone.

After taking administrative and internal steps to move the FHA Funds and operations to a sound financial footing, I and my team drafted a reform proposal and persuaded the HUD Secretary and the Office of Management and Budget (OMB) to support a Chief Financial Officer for the agency, a Comptroller for FHA mortgage insurance operations, audited financial statements, and reporting of credit and liability programs on an accrual basis. This included proposals that appropriations would be required to originate mortgage insurance and other credit expected to generate losses—the equivalent of a loan loss reserve.

During this time, I received advice and support from the General Accounting Office (now the Government Accountability Office), including the Comptroller General Chuck Bowsher. Chuck was well respected in Congress and within the Administration. He was instrumental in Congress’s passage of the Single Audit Act of 1984, requiring annual audits for state and local governments. My coordination with OMB, on the other hand, involved working with William Diefenderfer, who I described in my article, “William M. Diefenderfer: The financial hit man of student loans” (https://home.solari.com/william-m-diefenderfer-the-financial-hit-man-of-student-loans/). As I explained in that article, having Diefenderfer later serve on my company’s Board of Directors “was one of the worst personnel decisions I have ever made.”

My reforms for the mortgage insurance operations were adopted through the HUD Reform Act of 1989. OMB and Congress then introduced them government-wide with the Chief Financial Officers (CFO) Act of 1990 and the Federal Credit Reform Act of 1990.

The CFO Act was signed into law on November 15, 1990. The CFO Act required annual, audited financial statements for the United States Government and its federal reporting entities. In order to apply the statutes of the CFO Act, Brady as Secretary of the Treasury, Dick Darman as head of OMB, and Chuck as the GAO Comptroller General established the Federal Accounting Standards Advisory Board (FASAB) to develop the “applicable accounting principles” for the newly required financial statements.

No one could have guessed at the time of its creation that the FASAB would be used three decades later to destroy federal financial reporting and Constitutional government through an obscure accounting policy called FASAB Statement 56.

Throughout the process of implementing these reforms, my relationship with Secretary Kemp deteriorated steadily. Kemp was challenged by the operational complexity of HUD and the desire to say he was running HUD according to the law, on the one hand, while, on the other hand, managing the political necessity of keeping the money flowing out the back door. This engendered multiple personality disorder management of the first order—with Kemp giving me an order to do something and then ordering one of my deputies in confidence to make sure I failed. He demanded that people be fired or framed arbitrarily, which I would not do—and he would insist that I take responsibility for whatever their supposed foible was. I received complaints that my skirts were too short and that my house was bigger than his house—he would not come over if invited as he would “find it castrating.” My greatest offense, however, did not come directly from me. The word got around Washington that if you wanted anything accomplished in the operations at HUD, you had to see Fitts, not Kemp. There was a great deal of truth to that statement. Kemp’s refusal to learn the operations or respect the laws and regulations that bound the bureaucracy, and his attempts to override the complexity with temper tantrums and bullying had inspired a backlash of passive-aggressive behavior. One particularly long temper tantrum was laced with the comment, “The law? The law? I don’t have to obey the law. I report to a higher moral authority!” Whatever “get-out-of-jail-free card” Kemp had, the people who worked for him did not share it.

This period provided me with tremendous insight on the media. I was dealing at the heart of the cash and credit flows involving hundreds of billions of dollars of government resources that were driving trillions in the capital markets. What was happening in the financial flows was entirely divorced from what was being described in the national and global media. The numbers did not lie, but the nightly news did. More important were the material omissions of what was not discussed. At one point, a top investigative reporter from the New York Times contacted HUD, requesting permission to write a policy piece about the work I was doing. She had heard about it from members of the OMB team. After some resistance from the Secretary’s office, she proceeded with the piece. She then proceeded to run into resistance for weeks from her editor who kept asking her to run down false rumors about me and my operation. Finally, she submitted the story, only to receive a call from the print shop in New York. The editor was changing the article under her byline without telling her—adding in things that were not true. She reported this to the New York leadership. The result was that she resigned from the New York Times and never worked as a reporter again. I found out later that the source of the false stories—the person who had lobbied the Washington editor for weeks—was Roger Stone, then a partner at Black, Manafort & Stone, a lobbying firm rumored to be the ultimate in “swamp critters.” I assume he was acting on behalf of Kemp and his staff.

When the Bush Administration went to war with Iraq, it was time for me to go. I left convinced that for communities to work, taxpayers, small businesses, and entrepreneurs would need to build private data, systems, and economics. Get the federal government out—and keep them out. New technology meant entrepreneurs and markets could help create higher learning metabolisms and productivity in communities. We could end poverty without spending government resources—indeed, we could lower taxes.

I did not yet understand that pouring government subsidies and loans into places was often about central control and private profits, not about sound investment. As long as you could print money, let the party and the waste roll on.

Videos:

C-SPAN – HUD Reform Press Conference

HUD Reform Press Conference

- C-SPAN – Housing for America’s Future

- C-SPAN – Discrimination in Home Mortgage Lending

Audios:

The “Kemp tapes” – In the late 1990s, Catherine’s attorneys asked her to record her recollections of working in the Bush Administration. She recorded a series of cassettes that, over time, passed around the Internet.

https://home.solari.com/the-kemp-tapes/

Articles:

“Loss of $4 billion is found in audit of mortgage fraud” by Jeff Gerth, The New York Times, Sept. 28, 1989

https://www.nytimes.com/1989/09/28/us/loss-of-4-billion-is-found-in-audit-of-mortgage-fund.html

“It’s hard out here for a pimp: Kemp, Cuomo & Pedophilia in Bush I”

https://library.solari.com/its-hard-out-here-for-a-pimp-2/

“Austin Fitts better be good with hammer and nails,” Business Week, Nov. 27, 1989

https://home.solari.com/wp-content/uploads/1989/Business_Week-27Nov1989.pdf

“My experience with FHA-HUD: Background information for understanding tapeworm economics” – In 2003, I was challenged to document my statement that HUD was “not working.” In fact, it was the official story of how it was supposed to work that was a lie—it was working as it was supposed to work, with billions flowing out the back door. The proof was to be seen in the fact that numerous legitimate reform efforts had been systematically stopped. When the material was reviewed in detail with a business leader who had been instrumental in the smear attack on me and Hamilton, I was told that he realized how he had been used and had to excuse himself to go to the men’s room—he was that upset.

http://www.dunwalke.com/gideon/fhalist.htm

“The U.S. statutes creating modern constitutional financial management and reporting requirements and the government’s failure to follow them” https://constitution.solari.com/the-u-s-statutes-creating-modern-constitutional-financial-management-and-reporting-requirements-and-the-governments-failure-to-follow-them/

Related Reading:

HUD Reform Act of 1989 (see, in particular, Subtitles B and C on Management and FHA Reform)

https://www.govinfo.gov/content/pkg/STATUTE-103/pdf/STATUTE-103-Pg1987.pdf

Wikipedia: “Savings and loan crisis”

https://en.wikipedia.org/wiki/Savings_and_loan_crisis

Wikipedia: “Iran-Contra affair”

https://en.wikipedia.org/wiki/Iran–Contra_affair

IV. Building Hamilton Securities

August 1990–November 1995

~ Mike Eisensohn of Harvard Management to Catherine Austin Fitts after learning of her competitive bidding design for the first $750 million HUD auction, which included defaulted mortgages on properties managed by NHP, Harvard’s HUD management company

~ Dick Ravitch, Chairman, AFL-CIO Housing Trust and later Lt. Governor of New York

Working in the Bush Administration had made two things clear about the reforms underway to reengineer the financial system. My first observation was that the securities markets were going to grow, including the securitization of the mortgage and real estate industry. This was confirmed after I left HUD, when Richard Breeden, Chairman of the Securities and Exchange Commission, asked me to join his Emerging Markets Task Force. After approaching countries throughout Eastern Europe and Asia about starting stock markets, his staff had discovered that their priority was also to start liquid mortgage markets. The second thing that was abundantly clear to me was that the Internet and digital communications would have a dramatic impact on all aspects of the global and domestic economies.

I was approached by National Housing Partnership (NHP), a large multifamily property manager owned by the Harvard Endowment and an investment company run by one of Harvard’s board members, “Pug” Winokur. The CEO of NHP asked me to start an investment banking company to handle a major portion of NHP’s investment banking transactions. My research indicated that—thanks to advances in digital software and database technology—the cost of starting an independent investment banking operation had dropped dramatically.

I finalized a written contract with NHP and its CEO, proceeding with a verbal commitment and shaking of hands. To my surprise, Harvard’s representative then interceded and tried to renegotiate and then abrogated the contract. When I insisted that NHP honor its contract for one transaction underway, I ended up poisoned, barely able to walk for months until enough water and sleep put me back on my feet—no doctor being able to figure out what in the world was wrong. I proceeded without the NHP contract, instead winning a competitive bid for my new company, Hamilton Securities Group, to serve as lead financial advisor to the FHA/HUD.

Growing up in Philadelphia, I occasionally interacted with the Italian mafia and their children. Throughout my career, I have also interacted with the Harvard Endowment and its representatives. When it comes to mobsters and fraudsters, I prefer the Italian mafia to Harvard. In my experience, the Italian mafia puts on fewer airs and has more respect for families.

After starting Hamilton Securities, I was asked by Secretary Brady to join the Federal Reserve as a governor. When I declined, John Sununu, then chief of staff to President Bush, arranged for the President to appoint me to the board of directors of the Student Loan Marketing Association (Sallie Mae). While on that board, the Chairman invited me to join the Council on Foreign Relations but wanted me to ask Nick Brady to sponsor me. I declined to do so.

One of Hamilton’s earliest assignments was the recapitalization of Battery Park City Authority in New York City—a success story of which I became particularly proud. Harry Albright, former chairman of the Dime Savings Bank, was the Chairman of Battery Park City Authority. I developed tremendous respect for Harry, who then invited me to join the board of the First American Bank after District Attorney Morgenthau appointed him to clean up the situation following the failure of the Bank of Credit and Commerce International (BCCI). First American and the Department of Justice (DOJ) were in litigation over the assets in the financial carcass. The first thing Harry did was have First American’s Washington litigation counsel send out thousands of pages of legal documents in a Brinks truck to my home in McLean, Virginia.

I will never forget the long weekend I spent reading those legal documents. I had rented a modern home in Virginia that stood on a butte overlooking the Potomac River. The living room was all glass, and the local hawks and one eagle regularly entertained me with flybys in front of the windows. Being a speed reader, I consumed legal documents for three days straight in my sunny solitude. When it was over, my paradigm had shifted.

I understood that the banking shenanigans at First American and BCCI could only have happened with the help and approval of the U.S. government, including enforcement, intelligence, and central banking agencies—and no doubt the G7 central banks as well. The financial fraud flowing out of the Iran-Contra years was a top-down phenomenon. Given the harm done, it was particularly egregious for the DOJ to claim the carcass for their asset forfeiture fund at the cost of the First American depositors. Helping Harry protect the depositors was certainly worth doing.

When I left the board several years later, I had dinner with Harry in New York. He talked about the extent to which the United States economy had become dependent on arms sales and financial engineering. Harry was too discreet to say “financial fraud”; however, after dealing with DOJ on the BCCI/First American scandal, we both know what he meant when he said “financial engineering.” He was deeply worried about where America was heading. My own worries included the rumors that the asset forfeiture fund at DOJ was financing secret, highly classified intelligence operations.

As financial advisor to FHA/HUD, Hamilton Securities designed and led $10 billion of mortgage auctions for FHA. By improving the recovery rates on defaulted mortgages from 35% to an above-industry-average of 70% to 90%, loan sales were able to generate $2.2 billion of savings for the FHA Funds. According to reviews by the GAO, the results were favorable for the real estate and local communities. However, the improvements for FHA Fund performance were not popular with the people who had been profiting from low recovery rates, such as NHP and the Harvard Endowment. Government and community failure is very profitable for those invested in it—a bigger group than you might think. I describe these issues in greater detail in the “Hamilton Securities Group” chapter of Dillon Read & Co., Inc. & the Aristocracy of Stock Profits (https://dillonreadandco.com/hamilton-securities-group/).

The beneficiaries of failure included servicers on the defaulted portfolios such as John Ervin & Co. Without HUD’s large portfolios of defaulted mortgages, Ervin would have no business. Another beneficiary included the HUD Inspector General’s (IG’s) office. Distressed mortgages held by HUD meant the IG’s office could make money doing enforcement actions and applying civil money penalties. When FHA staff explained to the HUD IG that the money they were making was less than the FHA Fund was losing by not selling, the IG explained that they did not care about the FHA Funds or the taxpayers—they cared only about what they could make. In other words, the agency’s own auditor was financially vested in keeping more money flowing out the back door to developers who were not paying their debt service. This was, in part, thanks to the Congressional appropriators who were willing to increase government budgets as a result of their rising penalties, fines, asset forfeitures, and seizures—and the settlements that could be negotiated on threat of these actions and indictments.

The DOJ and the enforcement arm of government agencies were now—thanks to the U.S. Congress—Sheriff of Nottingham style moneymakers. “Just-us” racketeering was open for business, supported by plans to build private prisons and rendition centers globally. “Play ball or else” was the implicit threat.

Unfortunately, Hamilton’s goals of decentralized wealth creation conflicted with the numerous efforts underway to centralize control of capital and wealth, reflected in the push for globalization, the rejection of place-based development, the expansion of the private prison model, and the subversion of pension funds.

Globalization: The Clinton administration was committed to globalization, implementing NAFTA and the next round of GATT, which led to the creation of the World Trade Organization (WTO) at the end of 1994. While Hamilton’s work on place-based economic development focused on helping the American people succeed in the face of globalization, the administration rejected our proposals and instead encouraged significant increases in consumer, mortgage, student loan, and government debt. When Sir James Goldsmith came to America to try to prevent the adoption of these globalist policies, he provided a brilliant description of the inhuman policies underway.

https://home.solari.com/sir-james-goldsmiths-1994-warning/

Rejection of Place-Based Development: Hamilton proceeded to build software tools that would allow the general population to map out government financial flows in their neighborhood and Congressional district. We also continually found opportunities to save the federal government money by reengineering financial flows locally. Our due diligence showed that HUD could use the FHA’s foreclosed inventory to create three to five homes for the price of one new construction public housing unit. However, we were met with the complaint, “But how would we generate fees for our friends?”

Private Prison Expansion: Hamilton invested in a company to build local training and data servicing companies in low-income communities. Unfortunately, this threatened narcotics trafficking operations, related asset seizures, penalities and fines, as well as gentrification. As one Deputy Assistant Secretary of Housing in the Clinton administration explained to us, “Black people are hopeless. We are moving them out, and moving the Hispanics in.” One member of the HUD IG communicated that his colleague rejected our ideas as “computers for ni**ers.” HUD teamed up with the DOJ to start dropping SWAT teams into African-American neighborhoods as stock market investors started to speculate on private prison stocks. Ultimately, the DOJ’s for-profit subsidiary (created to market federal prison labor to federal agencies) created a dedicated data servicing division. The people who could have been doing data servicing in their community and generating taxes were instead in a private prison. The staggering cost to taxpayers was estimated in 1996 by the GAO to be approximately $154,000 per prisoner. (To learn more about the costs to taxpayers and profits to private prison investors, see the case study of Cornell Corrections in Dillon Read & Co., Inc. & the Aristocracy of Stock Profits.)

Pension Fund Subversion: One of Hamilton’s subsidiaries worked with a group of pension fund leaders on the feasibility and advisability of environmental, social, and governance (ESG) investing. We concluded that our economic problems were caused by federal investment having a negative return on investment. The solution was not for pension funds to change but rather for government to reengineer its investments to a positive return in a way that would make the pension funds money. Unfortunately, the pension funds were used instead to engineer a “financial coup d’état”—starting with a housing bubble. Over the next decade, Americans built and bought larger homes that they could not afford, financed with their own retirement savings.

By the end of this period, FHA had made enormous progress in cleaning out its portfolio of distressed mortgages, inspiring Barron’s Washington editor to publish an article titled, “At last, HUD does something right.” The traditional HUD constituents, however, were not happy with fiscal and financial responsibility at FHA. A lot less money was flowing out the back door.

Solari Report:

Hamilton Securities with Jon Rappoport

https://library.solari.com/jon-rappoport-and-catherine-discuss-hamilton-securites-april-25/

Navigate the Housing Bubble, Parts I and II

https://library.solari.com/wp-content/html/BuildingRealWealth/HB4902.htm

Audios:

The “Kemp tapes” – In the late 1990s, Catherine’s attorneys asked her to record her recollections of working in the Bush Administration. She recorded a series of cassettes that, over time, passed around the Internet.

https://home.solari.com/the-kemp-tapes/

Articles:

“Sub-prime mortgage woes are no accident”

https://library.solari.com/sub-prime-mortgage-woes-are-no-accident/

“About Hamilton Securities”

http://www.dunwalke.com/gideon/about/index.html

“Edgewood Technology Services (Part One)”

“Edgewood Technology Services (Part Two)”

“Edgewood Technology Services (Part Three)”

https://home.solari.com/real-deal-edgewood-technology-services-part-one/

“My experience with FHA-HUD: background information for understanding tapeworm economics”

http://www.dunwalke.com/gideon/fhalist.htm

Books:

Dillon Read & Co., Inc. & the Aristocracy of Stock Profits, by Catherine Austin Fitts, March 2006: A comprehensive business-school-quality case study of the Washington-Wall Street relationship depicting the Hamilton litigation and surrounding events in the larger context of the central banking-warfare model and political economy operating in the U.S. today.

https://dillonreadandco.com

V. The War on Hamilton

November 1995–September 2001

November 1995–September 2001

~ Mike Tyson

I never intended to spend 30 years of my life trying to prevent U.S. federal financial fraud or, when I needed help to prevent it or the harm it was causing, warning my fellow citizens and investors about it. I never expected to spend countless hours, year after year for three decades, reading complex, purposefully obtuse federal financial audits. I never expected to deal with physical harassment, poisonings, house break-ins, trolls, disinformation shills, limited modified hangout experts, hackers, and the endless, mind-numbing parade of swamp critters that protect the monies rolling out of the back doors of the U.S. government. Those were never on my list of life goals. I did it because the federal finances are at the heart of the matter—a door that every American citizen has to walk through if we are going to be able to survive, let alone be healthy and free.

What destroyed my family and my neighborhood, as well as millions of other families and neighborhoods? I came to understand that it all led back to the nature of the governance system and its ability to operate above the law—with all of us financing the machinery of lawlessness. This was a core issue at the heart of what was needed to bring real solutions—whether to heal the environment, end war without ceasing, heal the divide-and-conquer culture wars, fund our pension and retirement obligations, provide decent educations at reasonable cost, move from a debt to equity model and sound money, or address our health care issues. I had come to realize that all roads lead back to this one overriding financial mechanism.

When I started Hamilton, I wanted to build an investment bank that would create real wealth—that would take new technology and apply it in practical ways that would help individuals, families, businesses, and communities be more productive. Indeed, our prototyping at Hamilton indicated that the wealth potential was explosive. That is how we end poverty—by creating wealth.

Those hopes ended with the failure of the Clinton administration and Congress to reach a budget deal and with the U.S. federal government shutdown at the end of 1995. As the president of CalPERS, the largest pension fund in the country, explained to me in the spring of 1997, “They have given up on the country. They are moving all the money out starting in the fall.”

The financial coup d’état had begun. Among many other things, that meant bubbling the housing market in a manner that would generate significant funds and doing so with a significant round of new mortgage fraud. This was a coordinated effort by the leading member banks of the New York Federal Reserve and the federal agencies involved in housing and finance, including Treasury, the DOJ, and HUD.

Hamilton and the honest government officials we worked for at HUD represented one set of obstacles getting in the way of attempts to significantly increase mortgage fraud. Another was Gary Webb’s Dark Alliance story, which brought transparency to drug trafficking during the Iran-Contra period. Hamilton’s software tools and databases showed suspicious patterns of mortgage defaults in communities such as South Central Los Angeles, which threatened to expose even more about these fraudulent operations.

For example, following HUD’s initial attempts to produce audited financial statements as required by the CFO Act, I had a mortgage banker show up in my office at Hamilton insisting that the FHA’s outstanding mortgage insurance in force was many multiples of what was shown on the newly issued FHA/HUD balance sheet.

In short, financial transparency of federal financial flows in local communities threatened many constituencies—from narcotics operations to mortgage fraud to traditional political patronage. Failure generated many “fees for our friends,” as long as more government debt was available to finance it. Transparency about the extent of the global mortgage fraud could halt liquidity in the U.S. mortgage and fixed income markets. As the derivatives markets grew, the danger of such a liquidity event grew.

To clear the honest government officials and Hamilton out of HUD, the loan sale program was targeted by a series of fabricated investigations and qui tam (whistleblower) and related civil lawsuits. Hamilton Securities ultimately managed 18 audits and investigations, 12 tracks of civil litigation, endless smear campaigns, and targeting and harassment of employees and vendors. The multitude of covert tactics and dirty tricks my team and I encountered was mind-boggling—it was quite an education. The intentions and allegations were phony—although it took eleven years and many millions of dollars to prove it. Ultimately, my investment in building a website to document what was happening was a major factor in our success. No indictments were ever forthcoming and no penalties ever assessed. The process in such cases is designed to reverse the notion that the accused should have an opportunity to address their accuser before irreparable harm is done. Instead, the goal was to engage in irreparable harm so that the accuser would never have to back up their phony allegations and would have plenty of time for a fishing expedition, which was bound—or so the thinking went—to find something, anything.

To try and head off an extended litigation process, I made a significant investment of time working with reporters from the Washington Post. The reporters, who had been lobbied extensively by John Ervin (the government’s so-called “whistleblower”), did a significant amount of investigation. One reporter told me their conclusion that Hamilton’s “guilt” was for making money for the taxpayers. However, the HUD IG apparently had insisted that we were guilty of criminal acts. When I asked the reporters why they would not run with that story, one said, “In an office that leaks like a sieve, why will they not produce any evidence?”

I later became convinced that private corporations managing the PROMIS software system at DOJ had falsified documentation to help start the investigation. Such documentation would be classified—one explanation for why the HUD IG might not leak it. It would also explain why one phase of the investigation collapsed after we produced records from Hamilton Securities and my bank under subpoena discovery. There was no trail to any bogus offshore accounts.

The Washington Post reporters did indeed write a story. I was told it was quite favorable to us. However, it was pulled the night before it was supposed to run—and the reporters stopped speaking with us. I was later snubbed by Post publisher Katherine Graham at a party at her house. It was immediately thereafter that DOJ and HUD felt free to seize our offices on a false pretext. While inside Hamilton’s offices, the HUD IG General Counsel tried to engineer another false frame. The story of how it failed is one of the many miracles that occurred during that time.

After my New York Times experience in the Bush administration and this experience with the Washington Post, I turned my back on corporate media. From then on, my plan was to communicate directly with people. As for the corporate media, “Fool me once, shame on you. Fool me twice, shame on me.” When it came to money being stolen from the federal government, I was confident that the corporate media worked for the team doing the stealing. Indeed, Warren Buffet was on the Washington Post board and continued to enjoy mysteriously above-market returns as the housing bubble and financial fraud grew.

After our offices and copies of all of our software and databases were seized, including our place-based disclosure tool called Community Wizard, a contact called to tell me that all of Hamilton’s materials had been reviewed for integration into the design for a new search engine that would be launched by the CIA; it would be named Google. I just marked it as covert gossip, although I noticed that when Google emerged and eventually went public, they were using a similiar A/B share stock model that Hamilton had used, which had—I believed—literally saved my life. Even more noteworthy was what happened with Facebook. When my CFO at Hamilton had wanted to invest in a human resources software system, I had insisted instead that employees learn HTML and proceed to create and maintain their own files on the in-house intranet. When Facebook later launched, I realized that it solved the intelligence agencies’ data servicing problems; our research had showed that federal data servicing needs were skyrocketing—Facebook solved their problem by getting as many global citizens as possible willingly to update and maintain their own files.

When the Hamilton offices were seized, I sold my family farmland to my uncle Robin Willits to pay an attorney to help me. Our insurance company was refusing to honor their contracts at the time. The result was that Robin received a threatening phone call. A team of HUD IG and FBI enforcement people showed up at his New Hampshire home at night with a subpoena. In the middle of these events, he insisted he would support me and persuaded my family not to “drop me.” His courage and integrity made the difference then and for years to come as he refused to allow me to be wrongly isolated. Robin taught me many things – one was the extraordinary difference that one righteous man can make to maintain the divide between a lawful society and lawlessness.

As money gushed out of the federal government, it gushed into the buyout and private equity firms and into the stock market. It was the global investment equivalent of “supermarket sweepstakes” where the contestants have five minutes to fill up their shopping baskets. When I still had hopes of continuing business activities, I headed to a conference for the technology and related venture industry in Arizona organized for subscribers of Esther Dyson’s newsletter. I found venture capitalists throwing enormous amounts of early stage financing at companies that had no chance of succeeding. They were insisting that companies raise many multiples of what they needed to finance their operations. Only when the Internet bubble burst several years later did I understand what was happening. The venture capitalist invests $1MM. The company is then plumped up for an IPO. They sell the stock to the pension funds and retail investors for $100MM. Then the company goes bust—but the early investors walk away with $99MM. For all I know, they increase their winnings by shorting the stock when it goes down. It is called a “pump and dump.”

There were days it felt like the entire leadership of the U.S. financial system had gone mad. Everyone was interested in nominal—and, with rare exception, no one was interested in real.

I was offered an opportunity to settle my litigation in 1998—after several efforts to falsely frame us had failed—but under conditions that would let the bogus allegations hang in the marketplace. I decided instead to fight and force the government and its so-called “whistleblower” John Ervin into court, requiring them to put forward a shred of evidence to back up their smears. Hamilton sued the government to collect outstanding bills and finally sued Ervin for tortious interference. It’s a shaggy dog story that is much easier to understand now that the world has watched the FBI and the Department of Justice try to falsely frame the President of the United States with a salacious dossier cooked up by a former British intelligence agent with funding from the Clinton campaign. It used to be hard to believe that the Department of Justice would simply make stuff up—now, it’s common knowledge.

The decision to fight necessitated selling my home and moving out of Washington. The physical harassment was interfering with my personal life and health. I felt I would be better off living on an unpredictable schedule in multiple places—thus dramatically increasing the cost of surveillance and harassment. My hope was that it would require the DOJ, HUD, or whatever agency was funding the surveillance or harassment to request a contract reauthorization—something I believed would be difficult to get, given the failure of the phony frames. I sold my house and began a multiple-year process of liquidating my art, antiques, furniture, and library. eBay had just started, and I was able to provide work for former employees who started an eBay business liquidating Hamilton and my possessions. My company Solari, launched in March 1998, leased three SUVs, and we rotated them between my remaining employees and me while I proceeded to begin a decade-long process of driving hundreds of thousands of miles around America trying to understand what was happening in the real economy. I wanted to meet and get to know others who were trying to understand how to bring real solutions, and see what we could do about it. It also afforded me the opportunity to meet and spend time with the elder generation in my family. Before they passed away, I downloaded an extraordinary amount of family history. Between the wise elders in my family and the intelligence gathered from doing “pro formas” on how the money works in thousands of communities in all fifty states, I emerged with a much deeper understanding of the real economy.

In 1999, I was finally interviewed by one of the HUD and DOJ investigation teams (several had cycled off when they could not find anything wrong). It became clear that the people leading the investigation had no understanding of the relevant programs and facts. I spent most of the interview teaching them and then helping them formulate their questions so they made sense. The Assistant U.S. Attorney (AUSA) afterwards apologized to my attorneys and said that he would recommend that the process come to an end. However, when I called an attorney I was working with, who was an expert on black budget litigation, he explained that the DOJ would demote the AUSA and assign a new “hit man.”

Sure enough, the sympathetic AUSA was demoted, and a new AUSA, Rudy Contreras, was assigned. Meanwhile, however, I had been inspired by Gary Webb’s use of the Internet to make all of his underlying legal documents accessible, and we had decided to launch a website. By publishing chronologies, dockets, legal documents, and summaries, our team could simplify and explain a highly complex legal and financial situation, thus making it manageable for a variety of parties. After almost five months of round-the-clock work scanning documents and writing legal summaries, we launched the Solari website on the litigation. Shortly thereafter, the qui tam was unsealed, and the Judge who had maintained the qui tam under seal for many years without any evidence of wrongdoing resigned suddenly from the bench. Judge Stanley Sporkin was the former general counsel of the CIA, when the CIA and DOD entered into a Memorandum of Understanding regarding narcotics trafficking by CIA assets. I was so appalled at some of his later escapades that we published a hot seat dedicated just to Judge Sporkin.

In the process of trying to get to the bottom of things, Hamilton’s general counsel Carolyn Betts discovered that billions were going missing from HUD. It started with the HUD IG testimony in March 22, 2000, indicating that there were $59 billion in undocumentable adjustments from HUD during fiscal year 1999, with many more billions missing from the open balance (meaning fiscal 1998). Despite this testimony, no effort would ever be made to determine what had happened or to get any missing money back, and no audit would be completed (https://www.whereisthemoney.org/59billion.htm).

This money at HUD had gone missing during the period when the world was distracted by Monica Lewinsky and stories of sex in the oval office. However, it was clear to my team that honest people were being forced out by criminal means so that billions in assets could be shifted out of the government—and in a manner that would communicate to the wider Washington bureaucracy that it would be dangerous to stand in the way of the federal financial fraud tsunami. We set to work with a series of reporters and researchers to help investigate and warn investors and citizens that the government coffers at both HUD and DOD were being emptied and that the housing bubble was threatening the financial health of millions of investors and citizens around the world. We called it a “financial coup d’état.” One of the best-known efforts was Kelly Patricia O’Meara’s outstanding “Missing Money” series for Insight magazine that was published from 2000-2004. You can find that series at our Missing Money website at https://missingmoney.solari.com.

In 2000, I met with the Chief of Staff to the Chairman of the Senate Subcommittee that oversees HUD appropriations. The mortgage bubble was in full bubble mode. The staff member asked me what I thought was going on at HUD. I deferred my response and asked them the same question in return. The staff member looked me dead in the eye and said, “HUD is being run as a criminal enterprise.” HUD’s matrix structure means that the majority of its operations are run by large defense contractors, New York Fed member banks, the U.S. Treasury, and the Department of Justice—and those parties indeed were intentionally running HUD as a criminal enterprise.

Paul Rodriguez, editor of Insight, published “Thankless Task” in May, 2001 about the targeting of Hamilton Securities Group. His first article went up on the Internet on Friday afternoon. By Tuesday, the HUD Inspector General was “retired.” Several weeks later, Rodriguez’s associate, investigative reporter Kelly Patricia O’Meara, sent a series of questions to the HUD Inspector General’s office about their latest fiscal 2000 financial audits (which I had just extensively reviewed), which declined to publish the amount of undocumentable adjustments. Two hours later, the HUD Inspector General’s office faxed a message to Hamilton’s attorneys informing them that the investigation of Hamilton was closed. Rodriguez’s second Insight article, in July 2001, described the successful outcome: “HUD Gives Up With Fitts.” However, HUD Secretary Andrew Cuomo cut a deal with Ervin to make sure he would have funds sufficient to continue to litigate against Hamilton by himself. It was, after all, still a business—making sure the money could flow freely out HUD’s back door.

One of my challenges was that globalization was by then well underway—and the climate of frenetic greed again made it feel like we were living in a “supermarket sweepstakes,” with everyone trying to fill up their shopping basket with foreign and privatized assets. America was also enjoying the housing bubble. There was widespread support for the bubble and criminal cash flows to continue.

I and my team kept counting more money going missing from federal coffers. In the fall of 2001, I was working with Kelly Patricia O’Meara on a cover story in Insight about what was, by then, $3.3 trillion missing from DOD and HUD. The story was scheduled to publish on Friday, September 14th and would be delivered to every Congressional office. On Monday, September 10th, Donald Rumsfeld held a press conference at the Department of Defense, confessing that DOD was missing $2.3 trillion. Kelly and I assumed he was trying to get ahead of her blockbuster story. That night I said to Kelly, “nothing can stop this story from going mainstream now.”

Those were “famous last words.” I learned on September 11, 2001 never to say “never,” especially when it came to trillions missing from the U.S. government.

Solari Report:

Coming Clean with Eunice Boston

https://library.solari.com/were-making-coming-clean-the-interview-with-eunice-boston-available-to-all-solari-readers/

The CIA, NSA & Google with Nafeez Ahmed

https://library.solari.com/the-cia-nsa-google-with-nafeez-ahmed-2/

Hamilton Securities with Jon Rappoport

https://library.solari.com/jon-rappoport-and-catherine-discuss-hamilton-securites-april-25/

Navigate the Housing Bubble, Parts I and II

https://library.solari.com/wp-content/html/BuildingRealWealth/HB4902.htm

Articles:

“Buffet’s big bet on US federal mortgage credit & housing”

https://library.solari.com/buffetts-big-bet-on-us-federal-mortgage-credit-housing/

“HUD ethnic cleansing and the Dark Alliance allegations”

https://library.solari.com/hud-ethnic-cleansing-the-dark-alliance-allegations-2/

“The Fed did indeed cause the housing bubble” [letter to the editor, Wall Street Journal]

https://library.solari.com/the-fed-did-cause-the-housing-bubble/

Missing Money series by Kelly Patricia O’Meara, Insight, 2000-2004

https://missingmoney.solari.com/news-coverage/

Missing Money archive (including Kelly Patricia O’Meara’s Missing Money series)

https://Missingmoney.solari.com

“Narco-dollars for beginners: how the money works in the illicit drug trade” by Catherine Austin Fitts, Narco News, Oct. 24, 2001

https://library.solari.com/wp-content/uploads/2015/scoop_narco_dummies.htm

“Hamilton Securities litigation”

https://dillonreadandco.com/gideon

Hamilton Securities litigation – Summary of Events as of February 2001 (including documentation of HUD IG General Counsel falsification of documents in Hamilton’s offices)

https://www.dunwalke.com/media/summary.html

Stanley Sporkin hotseat

https://www.whereisthemoney.org/hotseat/stanleysporkin-DRAFT1x.htm

“Robin Launches a New Era: Meditations on My Uncle Robin at His Memorial Service at the Dover Quaker Meeting House

https://home.solari.com/robin-launches-a-new-era/

Books:

Dillon Read & Co., Inc. & the Aristocracy of Stock Profits, by Catherine Austin Fitts, March 2006: A comprehensive business-school-quality case study of the Washington-Wall Street relationship depicting the Hamilton litigation and surrounding events in the larger context of the central banking-warfare model and political economy operating in the U.S. today.

https://dillonreadandco.com

Related lawsuits:

Qui tam filed against Harvard regarding Russian privatization

https://dillonreadandco.com/resources/documents/US-complaint.pdf

VI. The War on Everyone

September 11, 2001–January 2006

~ Reverend Melvin Bufford, opening of Sunday sermon, September 16, 2001

~ Title of Catherine’s first article on 9/11, published on September 17, 2001